By Vericast

Financial institutions work hard to stay one step ahead of fraudsters and consumers are vehement about protecting their identity and hard-earned money. Unfortunately, criminals continue to evolve their schemes with the intent of separating institutions and customers from their funds.

Check fraud remains a consistent risk for financial institutions, consumers and businesses. Check fraud accounts for 66% of all types of payment fraud. According to the 2022 AFP Payments Fraud and Control Survey, 74 percent of organizations experienced check fraud.

Managing fraud incidents can incur a heavy burden to financial institutions, increase call volume to their contact centers and risk losing customers if the incident is poorly managed. Even if your institution’s stock checks are packed with security features, your customers can still order checks from an outside source — reputable or otherwise — or even print their routing and account numbers on check stock from an office supply store.

Fortunately, there are steps your financial institution can take and security features you can implement to help mitigate check fraud and its potentially devastating effects.

GET TO KNOW THE ANATOMY OF A CHECK

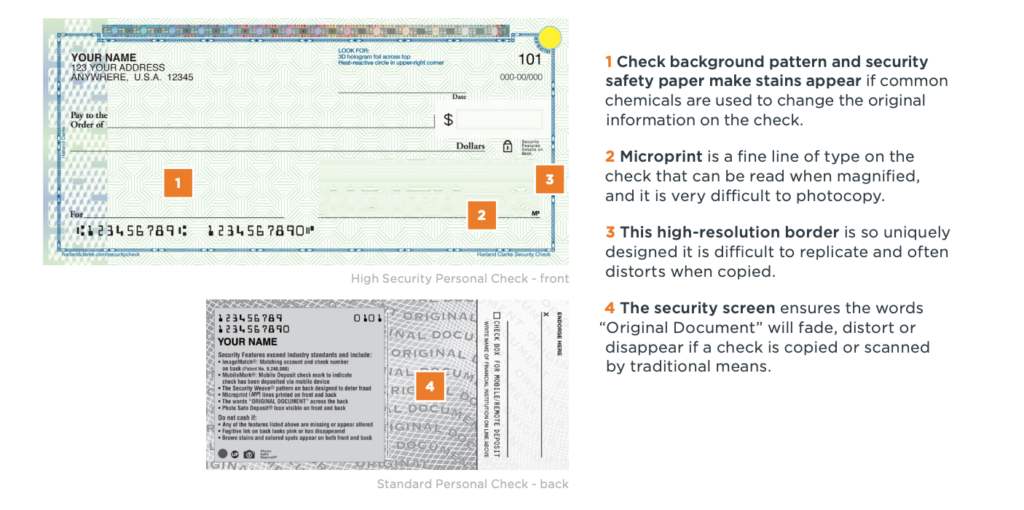

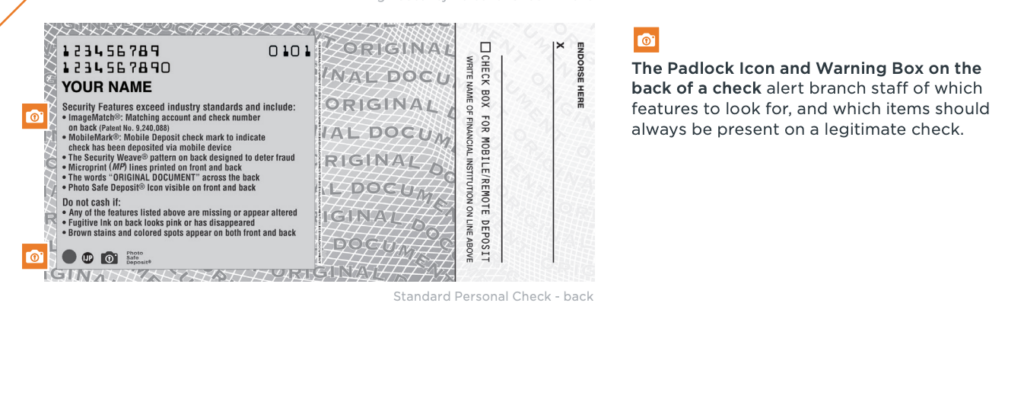

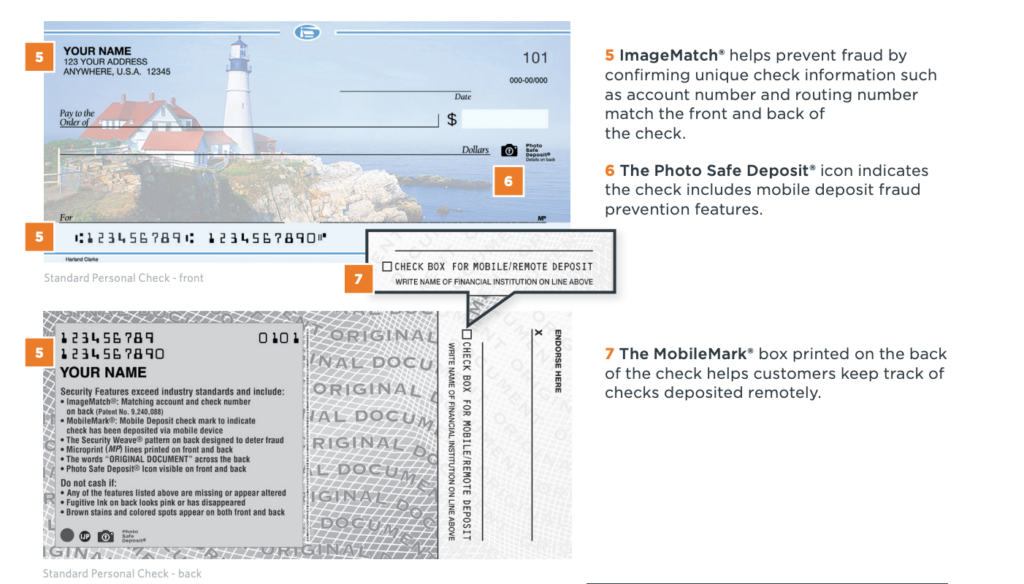

The best way to help protect customers is to ensure they and your branch staff know what your institution’s checks look like and the features they contain. Then, when an anomalous check (legitimate or fraudulent) is presented, they will know to give it additional scrutiny to verify its authenticity. Below you’ll find a list of key security features of our checks to look for so you can detect them and know what they mean when they appear in your branch. Here, you’ll get to know key security elements of our checks, the role each element plays, and how they all work together to help mitigate check fraud.

Difficult to counterfeit: Fraudsters want to move fast and will target the path of least resistance. If given the choice between a check with robust security features and one without, they will choose the lower security check. Our checks are designed to be difficult to counterfeit to discourage would-be counterfeiters from even attempting to do so. And if they do attempt fraud with our high security checks, the quality of the product they will produce with a scanner and inkjet printer will be so poor they would know it wouldn’t be worth the risk. Let’s take a closer look:

In-branch detectability: Easy-to-validate features give your branch staff the confidence to distinguish between an authentic check and a potentially fraudulent check. It is key to educate branch staff about how to identify fraudulent checks; this is why our checks make it easier to identify authentic checks by using certain features. Detect a fraudulent check in-branch:

Mobile check deposit applicability: As remote deposit capture (RDC) use increases, so does remote deposit capture fraud. After all, why would a fraudster risk showing their face in the branch when they could manipulate RDC to serve their purpose? We have stayed ahead of these fraudsters by developing RDC security features that are unique to our checks and designed to mitigate fraud. Our patented RDC security features help you detect fraud in all checks that come through your institution via mobile deposit, regardless of which bank or credit union they are drawn upon. We made remote deposit capture more secure:

HAVE CHECK FRAUD RECOVERY SYSTEMS IN PLACE

Resolution for your customers after an incident: Fraud recovery can be a very stressful and time-intensive process for customers to undertake alone. It is important to have processes in place to support your customers if and when they become victims of fraud. We offer CheckArmor®, a check fraud recovery service to help make customers whole again after an incident. In the unfortunate event of fraud, our fraud resolution services give check writers peace of mind with hands-on guidance and extended recovery support. Your customers will have the help and support of a dedicated fraud resolution specialist to walk through the fraud recovery process with them every step of the way so they know exactly what to do to isolate the event, resolve the fraud and help prevent future fraud incidents.

Be on the lookout for common types of check fraud. Fraud can occur in many ways, so it’s important to be vigilant and know what to look for. Some scams are common all year long, while others pop up seasonally. Train branch staff and share this information with customers, encouraging them to be on the lookout for these types of fraud.

EDUCATE YOUR STAFF AND CUSTOMERS

Check fraud represented one of the most common forms of fraud, accounting for 47% of industry fraud losses.5 Prevention is the best protection, so follow these three strategies to help minimize check fraud for your institution and customers.

Learn to spot a counterfeit check: Aside from the check security features mentioned previously, there are a number of additional attributes that can help identify fraudulent checks. Customers and branch staff should be aware of these and know what a fake check looks like if they happen to come across one.

Though check usage will continue to decline, they remain a popular payment method. Unfortunately, they’re also a popular target for criminals. Fortunately, you can help mitigate their illegal activity. With the right strategy, safety, protection and education in place, you can keep your institution and customers a step ahead of fraudsters.