Despite their different fundamental structures, credit unions and banks compete in the same market space for consumer and commercial deposits and loans. How do their shares of the market differ?

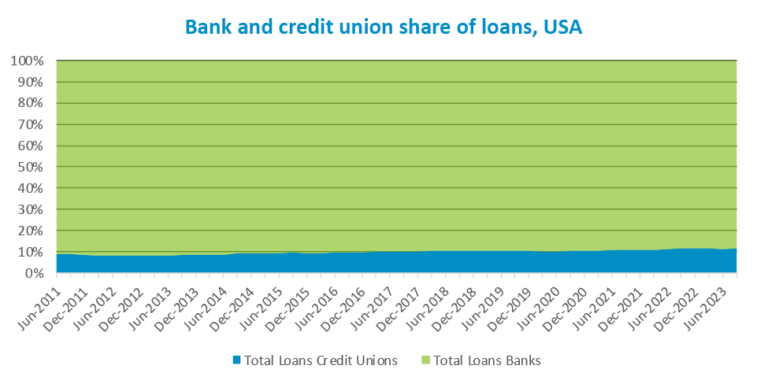

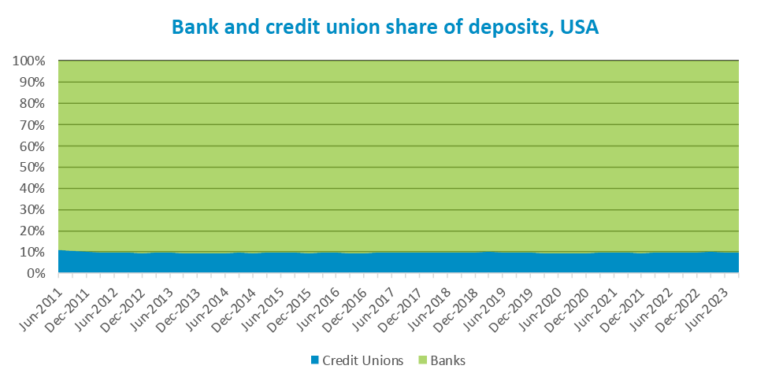

Nationally, banks own the lion’s share of loans and deposits. See the charts below. The blue line isn’t a border—that’s the credit union market share, averaging 9.79%. As you can see, the share is relatively steady through the last 12 years.

Credit unions tend to have the following steady market shares, nationally:

Why does this matter? Because since the start of credit unions—but especially in the last 25 years—banks have raised the cry that the credit union income tax exemption makes it difficult for banks to compete with credit unions. Clearly, banks aren’t having trouble competing with credit unions. If they were, wouldn’t the credit union market share be increasing? Wouldn’t banks be in danger, by now, of being out of business?

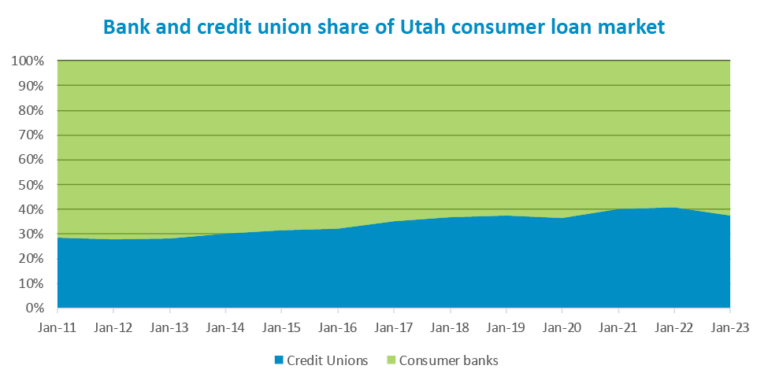

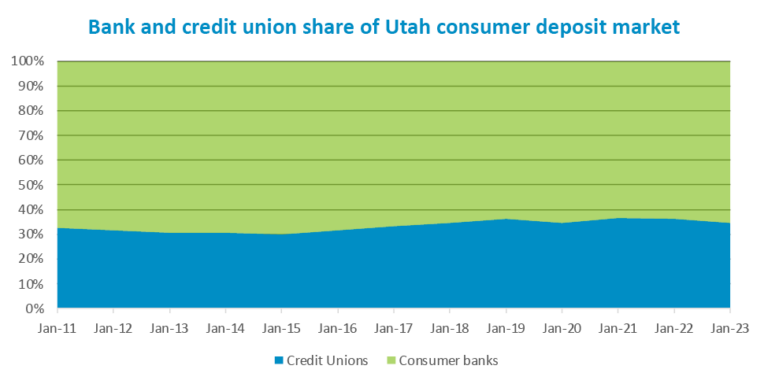

In Utah, the picture is slightly different. Due to favorable regulatory conditions in the 1980s, Utah credit unions succeeded in reaching more of the consumer market, and therefore have a larger share of the market than the national institutions.

While credit unions do hold more market share in Utah, and their share is increasing, the picture the charts paint isn’t a dire one for banks. In 12 years, credit unions gained roughly 3% of market share in deposits, and 8% in loans.

Using linear models to predict balances of deposits and assets, we can predict credit union market share in 100 years. Surely, by then, if there’s an urgent crisis for banks, credit unions will have run them out of business, right? Well, the predictions show that there’s no crisis. In fact, here’s what the linear prediction produces:

| Type of financial institution | 2023 deposit market share | 2123 Deposit market share |

|---|---|---|

| Bank | 65% | 61% |

| Credit Union | 35% | 39% |

| Type of financial institution | 2023 asset market share | 2123 asset market share |

|---|---|---|

| Bank | 67% | 61% |

| Credit Union | 33% | 39% |

The modeling predicts that credit unions gain so little for two reasons:

Clearly, there is no crisis for banks.