In 1970, Congress created the National Credit Union Share Insurance Fund (NCUSIF or Share Insurance Fund or, simply, the fund) to provide deposit insurance to protect the accounts of credit union members at federally insured credit unions.1 Like the FDIC’s Deposit Insurance Fund, the NCUSIF is backed by the full faith and credit of the United States government.2

The NCUSIF is administered by the National Credit Union Administration (NCUA), which is the independent federal agency that charters and supervises federal credit unions throughout the United States and its territories.

What makes the NCUSIF special?

Unlike the FDIC, which is funded by tax dollars, the NCUSIF was originally—and continues to be—funded by credit unions, not the American people.3 It was created with no government-provided start-up capital. Instead, insurance premiums assessed to federally insured credit unions were the fund’s primary source of capital between 1970 and 1979, and continue to support the fund.4

Why is NCUSIF share insurance coverage important?

Share insurance coverage offered through the NCUSIF protects members against losses if a federally insured credit union should fail. All credit unions in Utah are federally insured.

Historically, insured funds are available to members within just a few days after the closing of an insured credit union. However, failures of federally insured credit unions are rare because only those with sound operational standards qualify to receive NCUSIF coverage. The NCUA also reviews the operations of all federal credit unions and works closely with state regulatory authorities to evaluate federally insured, state-chartered credit unions.5

What basic coverage is provided by the NCUSIF?

The NCUSIF provides all members of federally insured credit unions with $250,000 in coverage for their single ownership accounts. These accounts include regular shares, share drafts (similar to checking), money market accounts, and share certificates.

Individuals with account balances totaling $250,000 or less at the same insured credit union are fully insured. If a person has more than $250,000 at any single credit union, several options are available for additional share insurance coverage because the NCUSIF provides separate insurance for other accounts.

Members have full NCUSIF coverage at each federally insured credit union where they are qualified members. While the NCUSIF coverage protects members at all federally insured credit unions from losses on a broad spectrum of savings and share draft products, it does not cover losses on money invested in mutual funds, stocks, bonds, life insurance policies, and annuities offered by affiliated entities.6

Does the NCUSIF provide additional coverage?

All members of federally insured credit unions have options for coverage that is separate from and in addition to the coverage available to their single ownership accounts. Coverage includes retirement accounts, joint accounts, trust accounts, revocable trusts and irrevocable trusts.7

In Summary

The reason the NCUSIF is so great is because it was funded by credit unions (as opposed to the FDIC, which was funded by taxpayers), to protect members, and no member of a federally insured credit union has ever lost a penny in insured accounts.8

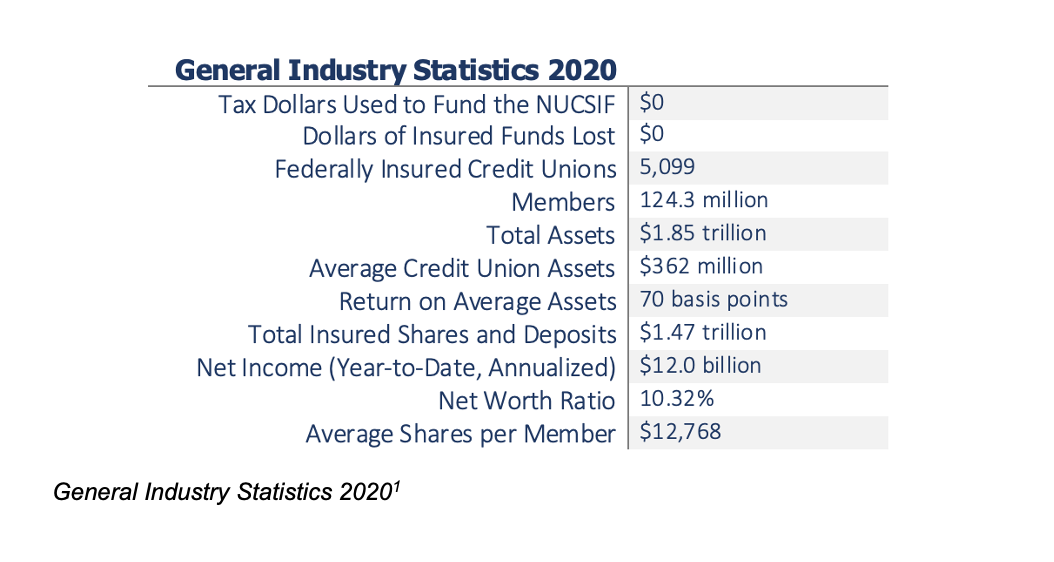

The 2020 NCUSIF statistics and financial report information can be viewed here.

[1] https://www.ncua.gov/support-services/share-insurance-fund

[2] https://www.mycreditunion.gov/share-insurance

[3] https://www.fdic.gov/about/what-we-do/index.html

[4] https://www.ncua.gov/support-services/share-insurance-fund/fund-history

[5] https://www.ncua.gov/files/publications/guides-manuals/NCUAHowYourAcctInsured.pdf

[6] https://www.ncua.gov/files/publications/guides-manuals/NCUAHowYourAcctInsured.pdf

[7] https://www.ncua.gov/files/publications/guides-manuals/NCUAHowYourAcctInsured.pdf