By: Vericast

Brands have gone through so many ups and downs in the last few years, and uncertainty looks set to reign going forward. But nothing compares to the exhilarating and occasionally terrifying thrill ride of the American consumer in these times. The expand-contract cycle of the economy amidst a whirring storm of pandemic, supply chain issues, war and looming recession has left many consumers queasy but still standing and eager to prove their resilience. It is against this backdrop that brands are peering into the new year ahead, trying with all their might to anticipate coming opportunities and challenges and be ready to adapt to both in real time. Here we present a list of key trends that we’re anticipating as we head into 2023 and back up our logic with some Vericast survey data. We also offer insight for brand managers, media planners and strategists on how brands might best position themselves to meet rapidly changing customer expectations, fuel their business and set their company up for long-term success.

Presenting 14 trends to watch in the coming year.

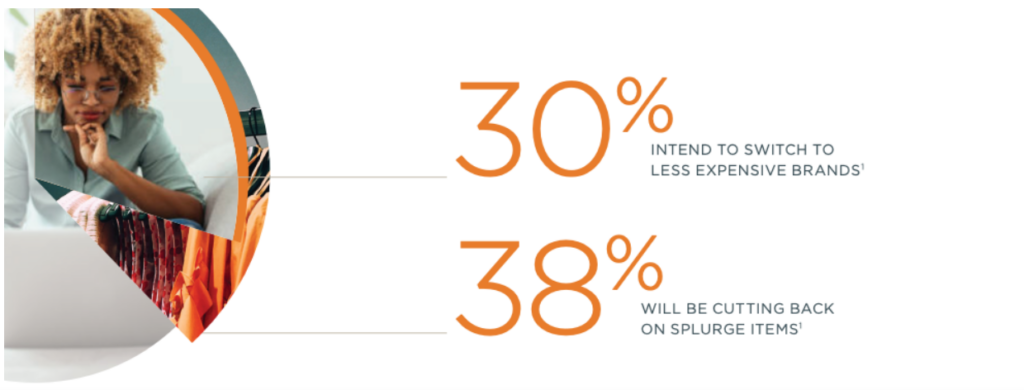

1: Consumers Will Pull Back on Spending in Multiple Areas

We expect that many consumers will continue to feel significant economic pressures. Their inevitable response will be to tighten their budgets across the board but especially where groceries, travel, entertainment and treats are concerned. In a recent Vericast survey, 38% of respondents indicated that they will be cutting back on splurge items while 30% intend to switch to less expensive brands.1

One area to watch on this front

Expect to see people revisiting which streaming services they subscribe to in 2023. Some 22% of our survey respondents said they would be cutting back on streaming services while 17% plan to bundle internet, TV and/or mobile phone providers to find savings.2

Expect growth to continue for wireless cable providers as people realize the cost savings and that the coverage is as good as their previous provider.

What can brands do to respond?

“Deals and discounts will help providers be more aligned to these emerging competitors,” says Jill Morgan, Manager, Telecom Client Strategy, “beyond that, providers need to figure out how to differentiate their services to stay relevant.

2: Discretionary Spending Will Somehow Endure

We expect that, while consumers will be sucking in their metaphorical guts after some financial belt-tightening, they’ll still spend on more than just the bare necessities. Tough economic times will require people to redefine a true “need” versus something they can nudge into the “want” or “nice to have” column. It will be a balancing act as they seek value and prioritize needs.

But, as needs take precedence over wants and discretionary spending shrinks, consumers will still seek to purchase things for their home and their family. The challenge for marketers will be to stay tuned in to behaviors and pain points across different segments of the population. “The key for brands,” says Sara Thomsen, Senior Manager, Retail Client Strategy, “is to be top of mind when people are ready to part with their hard-earned money and make a purchase.”

In the healthcare space, inflation and looming recession will lead people to reevaluate some procedures or put off elective surgery. “Parents are likely to prioritize spending on their children’s healthcare needs versus themselves,” says Susan Maurer, Client Strategy Director for Healthcare. “From a brand perspective, people only have so much time, so you’ll need to be highly relevant and provide a sense of convenience.”

3: Coupons Will Be Cool Again

When economic times get tough, saving becomes a sort of game — albeit an essential one — for consumers. In other words, getting a good deal becomes a big deal. For brands, the question becomes: How do you catch the eyes of those consumers in hopes of winning some of each precious dollar they spend? Our survey points in one clear direction as 66% of respondents said, in light of the current economy, coupons and discounts are more important than ever to them.3

Vericast’s August 2022 coupon redemption data showed several months of elevated redemption rates, according to Aimee Englert, Executive Director, CPG Client Strategy. “This trend supports that consumers are on board and actively seeking savings to counteract the cost of gas and groceries specifically, and inflation in general.”

It’s on brands then to make strong promotional offers that are meaningful — truly valuable to people — while delivering discounts in engaging and relevant ways. “Targeted, periodic savings offers such as coupons, rebates and sales will go a long way to keep consumers engaged,” Englert says. A recent Forrester Consulting study commissioned by Vericast suggested that marketers across multiple industries are already heeding this advice. Many respondents noted that their ad strategy for the coming year includes an emphasis on engaging promotions and discounts.4

Loyalty Will Go Missing

Our September survey laid it out pretty clearly: 53% of respondents agreed with the phrase “I have become less loyal to specific brands.” And that’s a sentiment that we expect to continue into 2023. Brands and retailers will — and should — continue their efforts to foster loyalty but reality will intervene here. The fact is consumers will be more focused on two questions — “Who can give me the best deal?” and “What have you done for me lately?” — that will inevitably bump loyalty from the top of their list of priorities.5

How should brands respond?

The Forrester Consulting study also revealed an increased emphasis by marketers on the kinds of loyalty programs and rewards that drive engagement and elicit loyalty.6 “Honestly, loyalty has always been a long-term marketing strategy. It takes shoppers time to become loyal,” says Julie Companey, Director of Client Strategy, Grocery. “Brands have to work to win the shopper, and then work to preserve that loyalty with their services, promotions, reward structures. In a time frame when shoppers are becoming less loyal due to inflation, retailers will need to lean on these proven approaches, but also focus on converting shoppers who are trying them out. It’s a share-of-wallet game right now.”

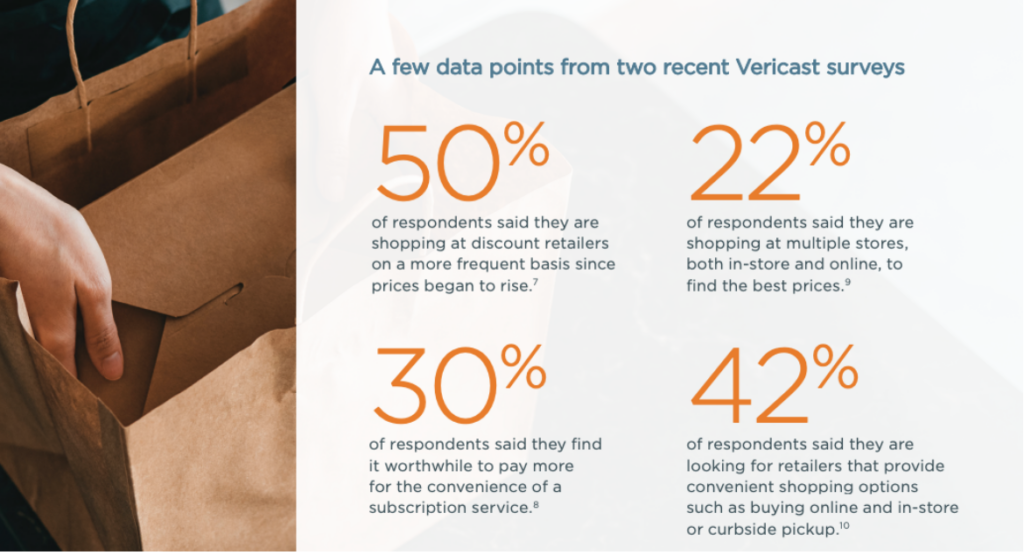

Prices and Convenience Will Drive Shopping Behaviors

Since we don’t expect loyalty considerations to drive shopping decisions, we predict that price and convenience will lead the way. People will do more online looking, will consider subscriptions for certain kinds of repeat purchases and will likely opt for discount stores when it saves them a few bucks. This has obvious impacts for consumer goods in grocery and other common retail stores, but also affects healthcare clinics and some other services.

Our industry experts shared a few thoughts for brands in key verticals. The common thread regardless of the industry? Brands should consider this an opportunity to provide value to their customers in the form of a convenient and cost-effective experience across all channels.

“Retailers should continue to provide value to consumers who shop your brand via pricing and promotions as well as experiential opportunities,” said Thomsen.

“Grocery stores can appeal to parents looking for convenience by promoting ready-to-eat and freshly prepared meal options available in-store or for delivery,” added Companey.

In healthcare, says Maurer, the increased competition due to provider, nurse and hygienist shortages will make convenience, customer service and easy access to health clinics essential.

Private Lebel Brands Will Gain Ground

Private labels have been gaining traction in recent years, becoming competitive not only on price but on quality and even their fast-improving branding. They are no longer the second or third choice on the shelf. We believe 2023 will be the year that private labels overtake name brands to capture the highest market share in the U.S. In our survey, 31% of people said they are buying more store brand products to save money while 30% said they are switching to less expensive brands.11 This trend will be interesting to watch in 2023. Private labels currently hold an 18.6% share and can potentially rise close to 25% in light of shoppers’ inflation concerns and increasingly impressive private brand product launches by retailers, predicts Companey.12

This could be the pivotal year for private brands, according to Companey. “They surged in early COVID due to CPG products that were out of stock — it turned out many shoppers were happy with what they tried. The 2022 FMI Power of Private Brands Study found that 52% of shoppers say they select retailers based on private brands. Since shoppers are more open to it, this is the moment to elevate awareness and acquire new shoppers by promoting private brands in circulars, on retailer websites and in display ads.”

People Will Get Increasingly Creative With Payment Options

When people used to step up to the register, payment options were as simple as “cash or credit.” Not so much anymore as an increase in alternate payment methods such as buy now, pay later (BNPL), digital wallets and person to person have come to the fore. With so many people facing increased financial pressures, these methods will be seen as a welcome (if risky, in the case of BNPL) trend.

Use of digital wallets and contactless cards will continue to grow. It’s worth noting that one study reflected that 57% of Gen Z respondents use mobile wallets.13

Another study found that three in five people surveyed have used a BNPL option at checkout to finance a purchase.14 As recession looms, some experts anticipate that usage of the platforms could grow, widening the risk for potentially overextended consumers, especially younger ones.

People Will Get Increasingly Creative With Payment Options

Indeed, 32% of people in our Vericast survey acknowledged they are looking for more ways to finance purchases and delay payments.15 Heading into 2023, look for an increased reliance on credit and alternative loan products.

The to-do for retailers looking to win that swipe? According to Lisa Nicholas, Vice President of Strategy, Financial Services, continue to make online shopping and checkout easier while catering to that growing segment of digital wallet and instant-issued card users.

“We will see more and more people turn to credit to cover their purchases as prices for home heating, groceries and other necessities continue to rise,” Nicholas says. “Financial institutions can send the message that they are working for — and not against — their customers by aligning themselves to their customers’ financial health and wellness.”

Nicholas contends that payment options and preferences are continuing to evolve for consumers so issuers must stay agile to remain top of mind and wallet.

The Return to the Office Will Impact Spending Habits

As office workers trickle back into hybrid or 40-hour onsite work situations, we expect to see purchase behaviors altered by the workday and the physical workplace. That means some shopping habits, frequencies and choices may change as people make their way back out into the world. Of course, things that had been centered around home since 2020 may now shift to new locations due to evolving work situations.

Nicholas says many employers appear to be adopting a balanced hybrid approach. She’s also tracking the advent of “Super Commuters,” people who are willing to commute a greater distance in exchange for fewer days in the office.

“As employers, financial institutions need to look at how they operate in order to retain employees,” Nicholas says. “What has traditionally been an ‘in-office’ sector is becoming hybrid or work from home as employers accept that many jobs can be done securely from home.”

She cites contact centers, remote lending and account opening, business development and many back-office roles as examples.

Consumer Will Look to Retailers For Inspiration and Education

What we buy and where we choose to buy it continue to be about more than just getting “stuff.” Now perhaps more than ever, it appears that people are looking to their banks and credit unions for financial education, to grocers for cooking inspiration, to healthcare providers for tips on healthier living and to restaurants for ideas on entertaining.

The best brands will make their advertising and selling about more than the end product. “Brands should consider how they can improve a consumer’s life or contribute to their well-being,” says Rob Crews, Director, Restaurant Industry Strategy. “And they are wise to articulate it in a way that is both tangible and actionable — something more than an empty brand promise. A brand is a promise, and a strong brand is a promise delivered.”

A couple of quick thoughts on this topic from a vertical perspective:

GROCERY

“Even in the face of rising prices,” says Companey, “we’re going to see retailers leaning into their role as a source of inspiration to consumers. Look for more grocers to offer tips on how to feed a family on a budget, more recipes incorporated onto websites and into mobile apps, more howto videos that allow shoppers to order ingredients directly from the video.”

HEALTHCARE

Maurer says continued hospital mergers, acquisitions and consolidations will increase patient frustration and confusion. The result? “There will be a heightened need,” she says, “for consumer education and a real focus on customer service.”

Self-Care Will Evolve Into Self Advocacy

Since you-know-what shut us down in 2020, self-care has emerged as a huge talking point. And while this would seem strictly like a healthcare-focused insight, it has applicability well beyond that realm. We’ve seen people working hard to take care of themselves — they’re trying to eat better, exercise more, pamper themselves when they can, splurge in small ways to give themselves a mental boost. On the other hand, inflation and looming recession are orienting people toward ways of saving money.

Looking at these two trends — frugality and self-care — together and it seems that something larger is happening. Consumers may take control of their own destiny and advocate for their own needs in a way that could be unprecedented. That might mean physical or mental healthcare or more basic emotional support and encouragement. People may be less likely to do something because someone told them to and more likely to seek out the best option, do all the research and strive to be part of a solution versus taking a “ready-made” solution off the shelf.

The Definition of “Omnichannel” Will – and Should – Change

It’s safe to say that everyone is now on board with omnichannel marketing. But have we oversimplified the word’s basic meaning along the way? For some brands, omnichannel means doing a bit of Facebook advertising or maybe using a Retail Media Network.

But, if we are to look soberly at effective omnichannel marketing for 2023, it’s really about surrounding the target audience in all areas of their lives. That naturally includes Facebook and other “walled gardens” but it must also encompass other places consumers go. In other words, a brand or retailer’s own app, wherever content is consumed on the internet, in social media feeds and digital out-of-home ads, on mobile devices, on TV or streaming services as well as in the mailbox (print and email). Whew, they don’t call it omnichannel for nothing.

“I think many brands, particularly in the restaurant industry, are guilty of this sort of narrow thinking that Facebook/Instagram can be the entirety of the digital portion of their omnichannel attack,” says Crews. “This is flawed thinking from the start, particularly as we consider some of the demographic limitations and penetration challenges you face in the walled gardens.”

Brands Will (Rightly) Increase Their Focus on Consumer Personalization

Retailers need to provide more personalized promotions to consumers based on their purchase habits and interests. So said 46% of the respondents in a recent Vericast survey.16

The best advertising has always been targeted, relevant and personalized. In 2023, we expect brands to work toward this ideal with renewed focus and energy. What form will it take? It will mean working with a lot of data (with a keen focus on 1st-party data) and leveraging it to understand, message, target and reach the right customers in the right channels.

A number of emerging tech and solution providers will play an outsized role in turning data into insight and action (see next prediction). Expect personalization to be a big focus for a lot of marketers in the coming year.

The aforementioned Forrester Consulting study revealed that marketers have high hopes for leveraging data to better understand and target their customers in the service of delivering the most relevant and personalized messages possible.17

Brands Will (Rightly) Increase Their Focus on Consumer Personalization

TELECOM

We believe that consumers in this vertical are getting savvier and will increasingly take advantage of the many choices they have in the telecom industry. The result? “Marketers will need to reach consumers more consistently as the space gets more and more competitive,” says Jill Morgan: Telecom. Consumers pay attention and respond to relevant messaging, so marketers need to personalize messages in order to make an impact with shoppers.”

RETAIL

Personalization is key in every step of the consumer journey, says Sara Thomsen: Retail. “Consumers want relevant marketing messages and product recommendations tailored to their needs. Of course, this allows retailers to examine their multiple media touchpoints and understand how consumers engage and respond.” Retailers need to work with marketing partners that understand their consumers as much as they do, Thomsen says, and be able to “read their customer data to create relevant, timely communications for customers within a scalable and efficient media model.”

Brands Will Double Down on Martech Innovation

What will the next generation of marketing strategies and tactics be built on the back of? Next-generation marketing technology. Period. Businesses will continue to find differentiation in these innovations. That means leveraging AI and machine learning. It means solving the metaverse to capture the imagination. And it means mastering more down-to-earth innovations like leveraging first-party data and getting a fully defined view of target audiences via CDPs.

Companies should look at how MarTech innovations can improve the customer and employee experience, says Nicholas. “Financial institutions in particular will continue expanding their reliance on cloud software to drive efficiencies as more and more people work from home, either some or all of the time.”

One final note on this front: a number of respondents to the Forrester Consulting study said “new ideas/innovation, AI and machine learning” would show up in more of their advertising strategy in the coming year.18

Influencer Marketing and Social Selling Will Dominate

If you’re looking for a break from the recent deluge of social selling and influencer marketing, get ready to be disappointed. Influencer marketing has dominated 2022 — 75% of marketers have used it and project to spend about $4.1 billion in the process — and 2023 promises more of the same.19

“The creator economy enables full-funnel marketing via influencer social posts and online comments and reviews,” says Englert. “This channel will continue to dominate and evolve, forcing marketing strategies to change.”

Expect livestream shopping to become an even more integral part of that equation in the coming year as it delivers an entertaining, fun and interactive experience for consumers. “Younger generations find authenticity and trust in their peers and influencers,” says Tina Seitzinger, Senior Director of Influencer Marketing & Paid Social, “so we will see more brands partner with influencers through livestreaming to bring products to life, create conversations, answer questions and ultimately drive purchases.”

As for the brands themselves? Those Forrester Consulting study respondents indicated they expect 2023 advertising strategies to be marked by more social media and digital advertising as well as improved website and digital presence.20