The Association’s latest summary of quarterly Call Report data, with a focus on Utah credit unions, is available for download here.

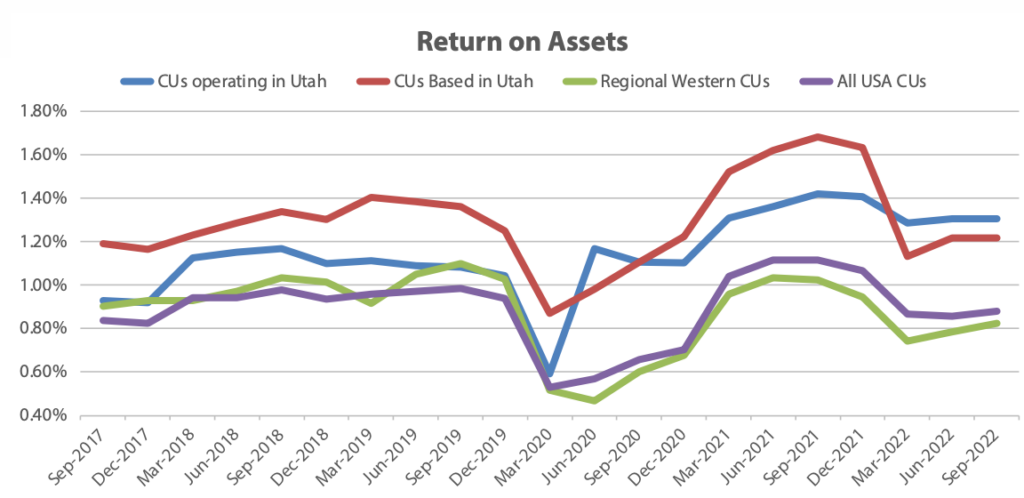

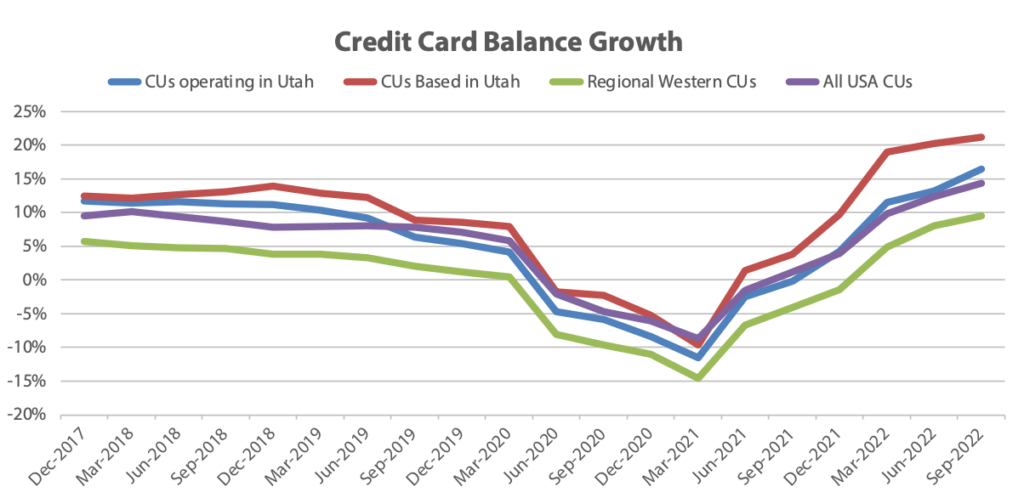

The report confirms many trends already reported by industry economists, such as tremendous loan growth and increasing net interest margin and income.

A few notable points:

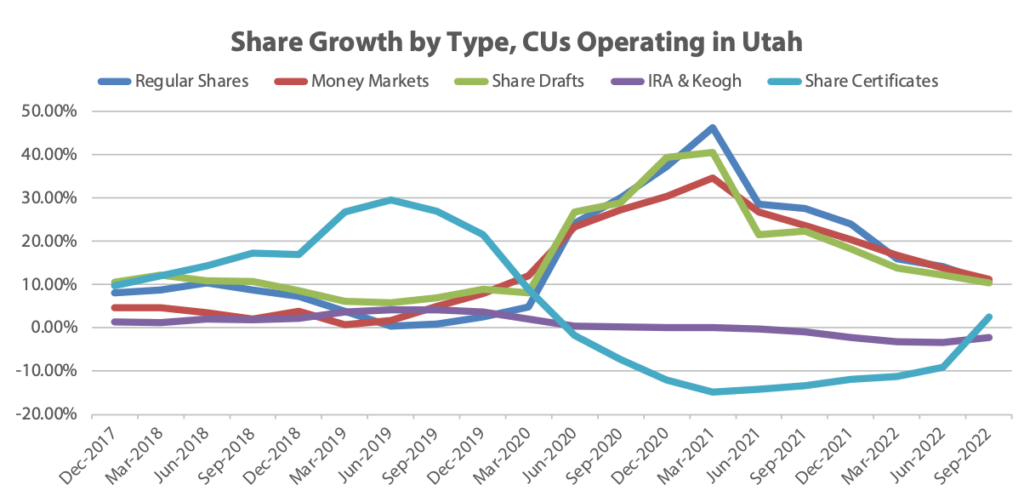

The report is designed to be easily digested, with numerous bright, easy-to-read charts that compare Utah-based credit unions, credit unions operating in Utah, regional western credit unions, and all USA credit unions—without a lot of commentary. Glancing through the report typically takes just a few minutes.