Credit unions are financial organizations that are structured in a cooperative model. Members purchase shares in the organization and the money is pooled together and used to provide financial services to the members.

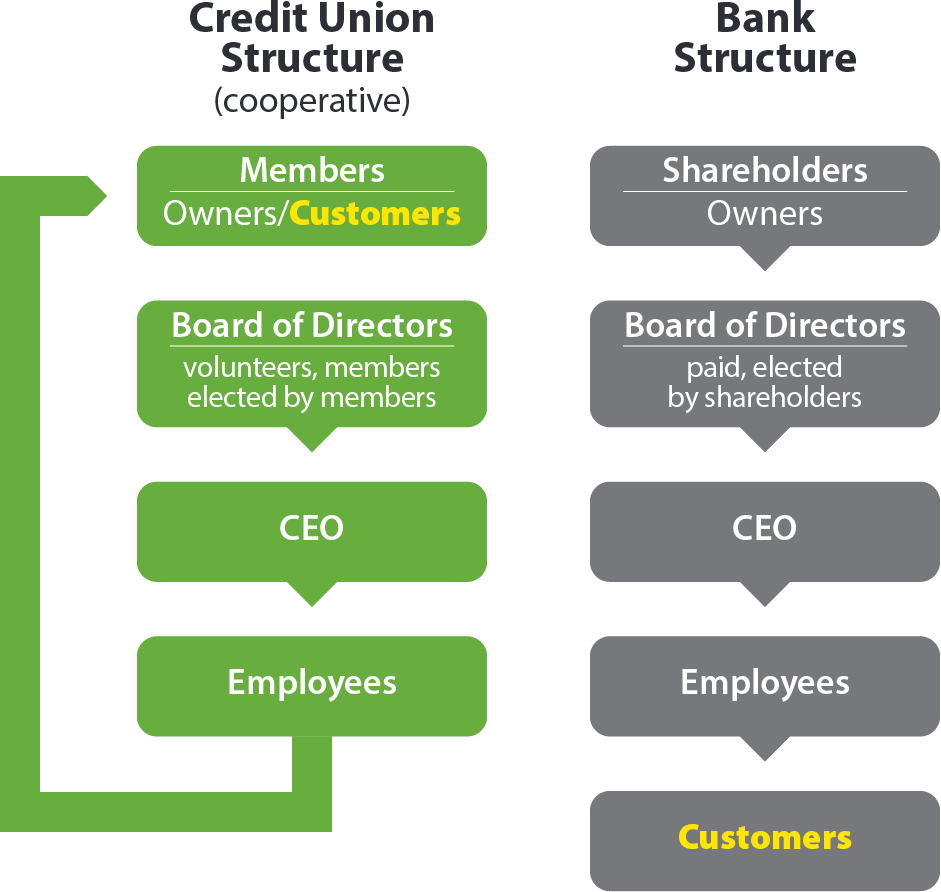

Credit unions are run differently than banks. Because credit unions and banks have similar products and services, people sometimes assume credit unions are banks; but we’re not. You, as a credit union member and customer, are the owner along with the other members of the credit union. This difference in structure makes a difference in how we do things for our consumers and communities. As part of the cooperative business sector, credit unions, no matter how large or small, share profits with members.1

What does it mean to be cooperative? It means to have mutual assistance in working toward a common goal.2 Being part of the cooperative business sector means being part of “an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned enterprise”. Cooperatives are democratically owned by their members, with each member having one vote in electing the board of directors.3

So what does that mean? That means members are at the top. (See image below)

Members at credit unions are engrained in every aspect of directing, electing, running and providing funds for each credit union. Members are literally cooperating with one another to help each other be financially successful.

[1] https://corporatefinanceinstitute.com/resources/knowledge/finance/credit-union/

[2] Oxford Dictionary

[3] https://en.wikipedia.org/wiki/Cooperative

[4] https://www.summitcreditunion.com/blog/kim%E2%80%99s-top-3-benefits-choosing-credit-union