Credit unions have an overall mission of improving the financial well-being of their members and serving their communities. You can expect several important benefits when you join a credit union, such as1:

Better rates on loans and savings accounts

Banks operate on a for-profit model and must deliver their profits to stockholders. This is why banks charge more and larger service fees and loan origination fees. While this model is great for stockholders, it doesn’t do much for members.

Credit unions, on the other hand, focus on members and reinvest more money into member perks that serve the entire credit union community.2

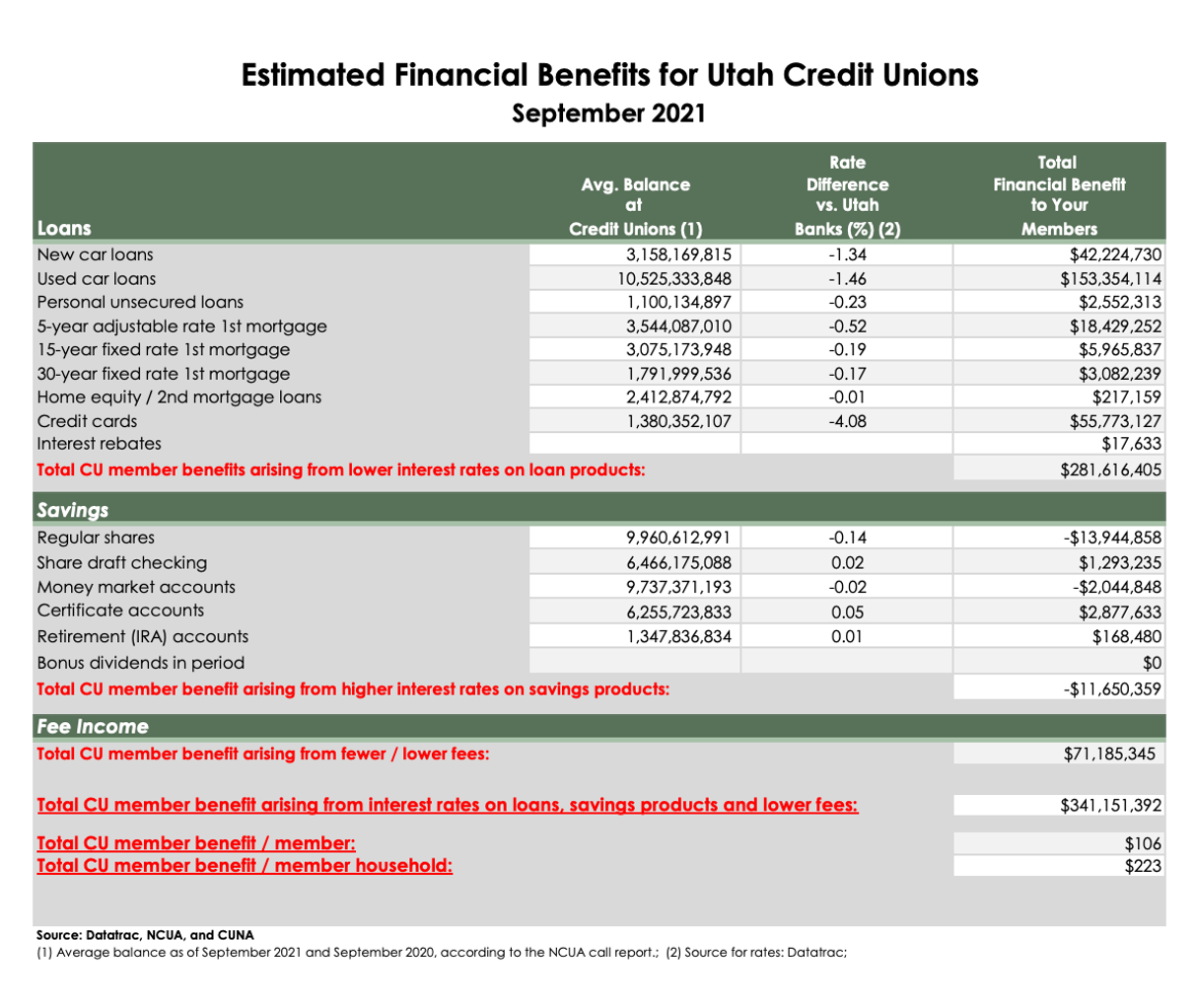

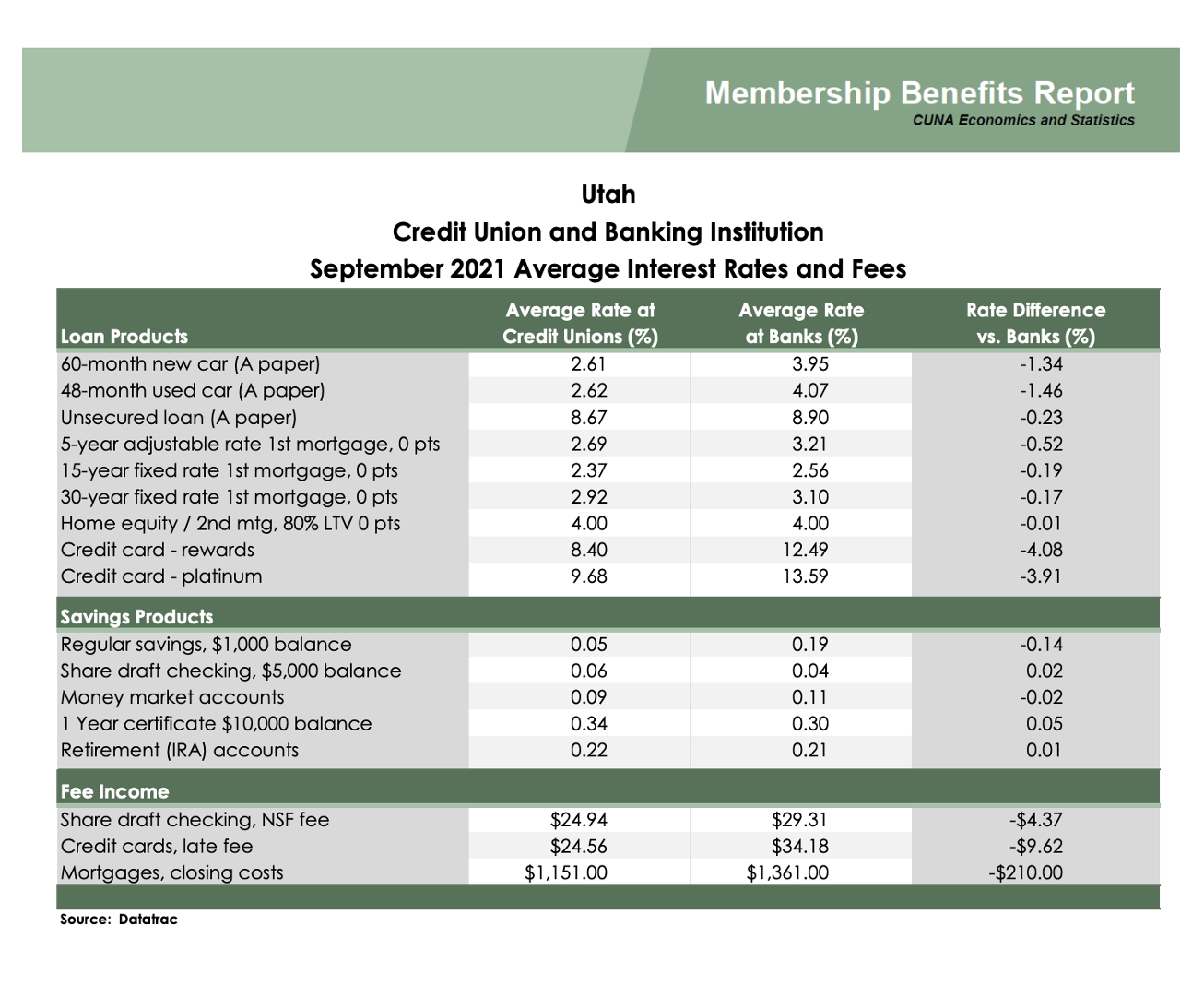

For example, the Credit Union National Association (CUNA) estimates that when compared to banks, Utah credit unions provided $341,151,392 in direct financial benefits to the state’s 3,215,194 members during the twelve months ending September 2021. These benefits are equivalent to $106 per member or $223 per member household.3

In particular, Utah credit unions offer lower average loan rates on new car loans, used car loans, personal unsecured loans, first mortgage-fixed rate, first mortgage-adjustable rate, home equity loans, and credit cards loans.

Utah credit unions also pay members higher average dividends on share draft checking, certificate accounts, and IRAs.3

Data also shows that:

Credit union members pay a 0.7% lower rate on new car loans and 1.4% less on used car loans than for-profit bank customers.4

Nationally, credit unions provide $18.9 billion annually in financial benefits to consumers through higher savings and returns, lower loan rates, and fewer fees.5

Credit unions generate $4.9 billion in annual benefits to all consumers due to the competitive presence of credit unions in local banking markets.5

Better customer service

Credit unions tend to rate more highly than banks on surveys of customer satisfaction. Because a credit union’s customers are also its owners, these institutions tend to be highly focused on providing customer service in a way that many banks aren’t inclined or able to match.

Community involvement

No matter what kind of neighborhood, city or town people live in, credit unions intend to connect their local community with affordable financial service. They can make a big difference in the financial lives of people who might otherwise be charged high fees from check-cashing services. Just by being present in their communities’ local banking markets, credit unions generate an annual $4.9 billion of economic benefits.2

Support for diversity and inclusion

Because they are so community oriented, credit unions have a strong focus on support for diversity and inclusion. CUNA wrote, “As not-for-profit, consumer-owned financial cooperatives credit unions are laser-focused on our mission of financial inclusion and serving our members.”6

Conclusion

For the majority of your financial management needs, keeping your money at a credit union may help you save on fees, get a higher yield on your savings, receive a better rate on a loan and improve your financial well-being—all while supporting an organization that makes special contributions to the economic empowerment of your community.

__________________________________________________________________________________________

[2] https://www.kfcu.org/resources/advice/top-five-benefits-of-banking-with-a-credit-union/

[3] https://www.cuna.org/advocacy/credit-union—economic-data/Benefits-of-Credit-Union-Membership.html

[4] https://www.aarp.org/money/investing/info-2021/credit-union-advantages.html

[6] https://news.cuna.org/articles/120473-cus-can-address-barriers-to-women-minority-owned-businesses