Right on schedule, the latest analysis of Call Report Data, with a focus on Utah’s credit unions, is available, confirming what every credit union executive already knew in their guts: it’s a tough environment.

But Utah’s credit unions continue to successfully navigate the rough waters.

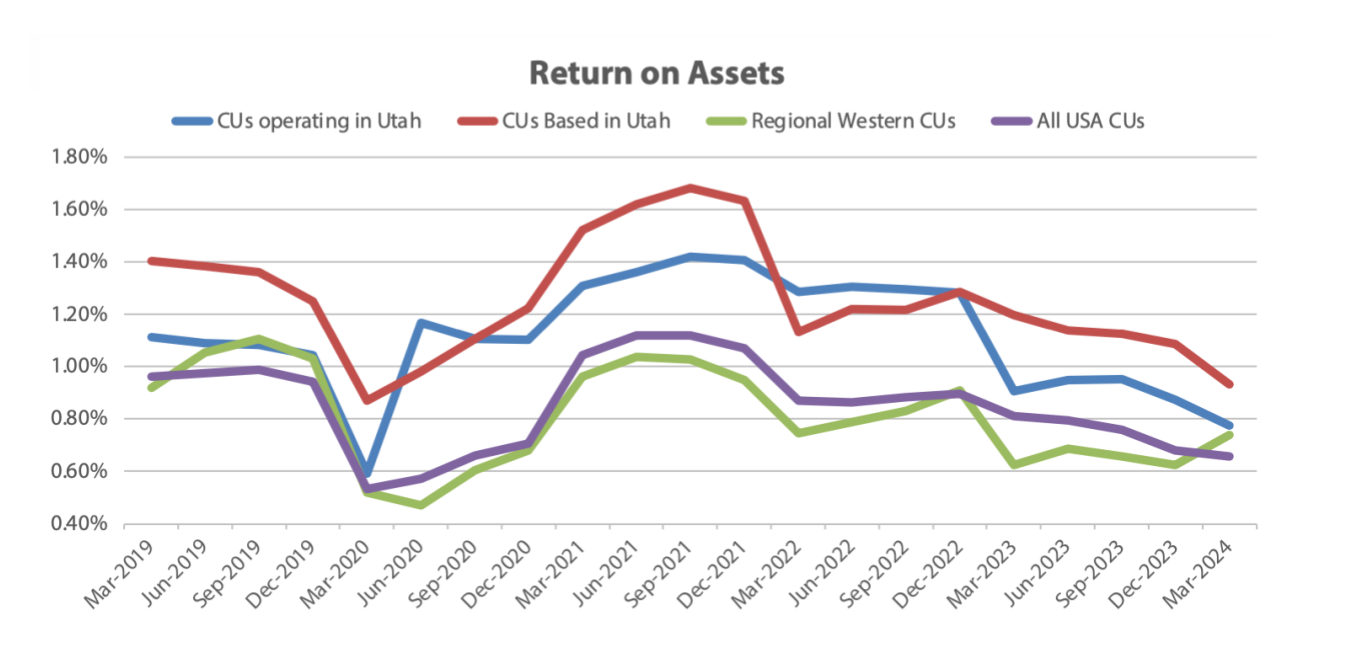

As in quarters past, Utah’s credit unions generally outperform credit unions across the nation. Twelve-month growth in loans, shares, capital, and assets at Utah credit unions outpaced the nation. As did ROA.

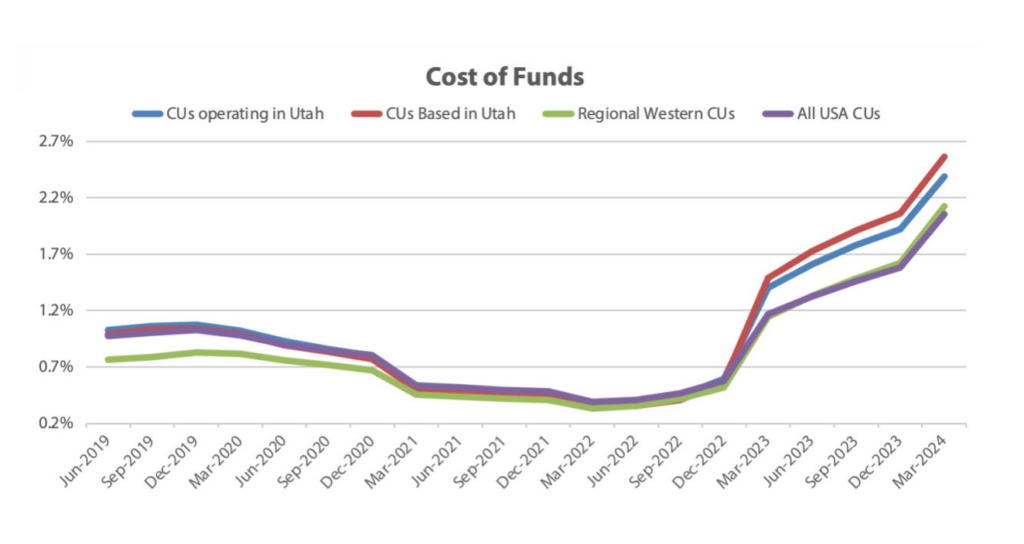

Nevertheless, across the country, while cost of funds continues to increase, income growth has leveled off. In addition, while credit unions generally continue to stay profitable, the net worth to assets ratio dropped slightly—a result of growing assets, not lack of income. Loan growth has slowed to pre-2022 levels. Delinquency has leveled off. Charge-offs have increased.

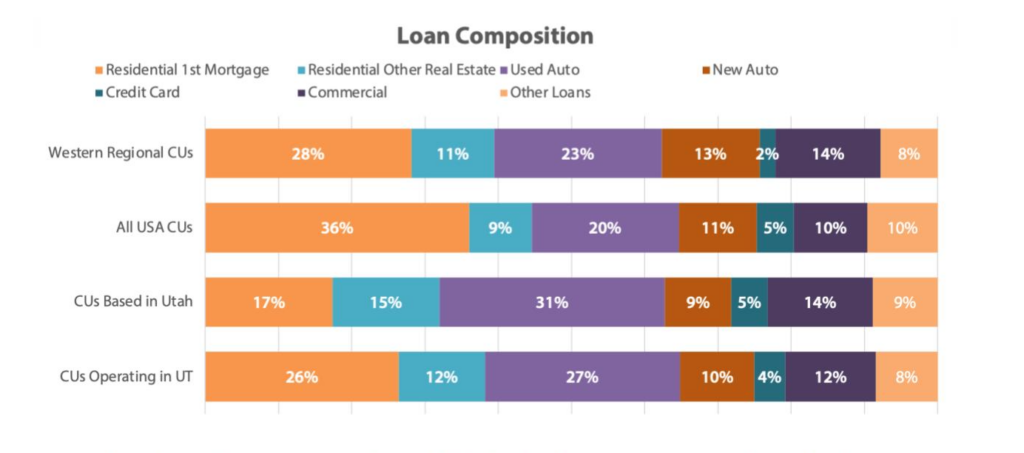

Perhaps one reason Utah’s credit unions continue to fare relatively well is that when consumers stopped taking interest in long-term, fixed rate mortgages in 2022, Utah’s Utah’s credit unions quickly made the transition to variable-rate mortgage loans. They continue to lend in that area more than credit unions throughout the country; a clear demonstration of an alacrity for meeting consumer demand.

Utah’s credit unions also tend to lend more in the commercial space than national peers. This flexibility and diversification has proven helpful to Utah credit unions and their members.

All of this information, and more, is available in the latest report, downloadable from the Association website, here.