Stephen Nelson

On June 24 the NCUA board approved a rule “to aid FICUs in adjusting to the new GAAP standards in a uniform manner and without disrupting their ability to serve their members.”

The rule accomplishes a few things:

What, exactly, do the above points mean? What are the implications for Utah’s credit unions? Read on!

Phase-in of day-one effects

The rule adopted by the NCUA board modifies the effect of any day-one effects of the CECL adoption for purposes of PCA rules. Let’s unpack that.

When a credit union adopts CECL, there’s a good possibility that its ALLL balance will need to increase because CECL attempts to recognize probable losses earlier. This increase will result in a one-time transfer from a credit union’s retained earnings to the ALLL account, and naturally result in a reduction of the credit union’s net worth ratio. These are the so-called “day-one effects”.

NCUA recognizes that this change in accounting practices could push some credit unions below required net worth ratio levels—below 7%, 6%, or 2%. Normally, under these circumstances, NCUA will apply additional corrective rules—it will take PCA. In the most extreme cases, this results in the NCUA conserving the credit union and probably closing it. In other cases, it means the NCUA will require the credit union to formulate a net worth restoration plan and subject the credit union more frequent and thorough exams.

Rather than potentially subject credit unions to these requirements due to an accounting rule change, the NCUA has decided that—for the purposes of PCA—it will change how it calculates the net worth ratio for three years following the adoption of CECL. This calculation applies only for purposes of PCA, and does not actually change the net worth ratio. It creates a new net worth ratio, of sorts (which I don’t believe the NCUA has formally named), which applies only for PCA purposes.

Note that the actual dollar amounts on the books—of assets and retained earnings—still reflect reality—and that real amount still applies for everything except PCA. But as far as PCA, the calculation of net worth will be adjusted to offset the day-one effects.

NCUA will do this calculation automatically for credit unions, and will do it for all credit unions that adopt CECL after December 15, 2022. I don’t know why a credit union would want to, but no credit union can opt out of this.

How will the calculation work?

The idea behind this is that rather than thrusting credit unions into a PCA situation with this one-time accounting change, credit unions will have three years to make up that day-one effect.

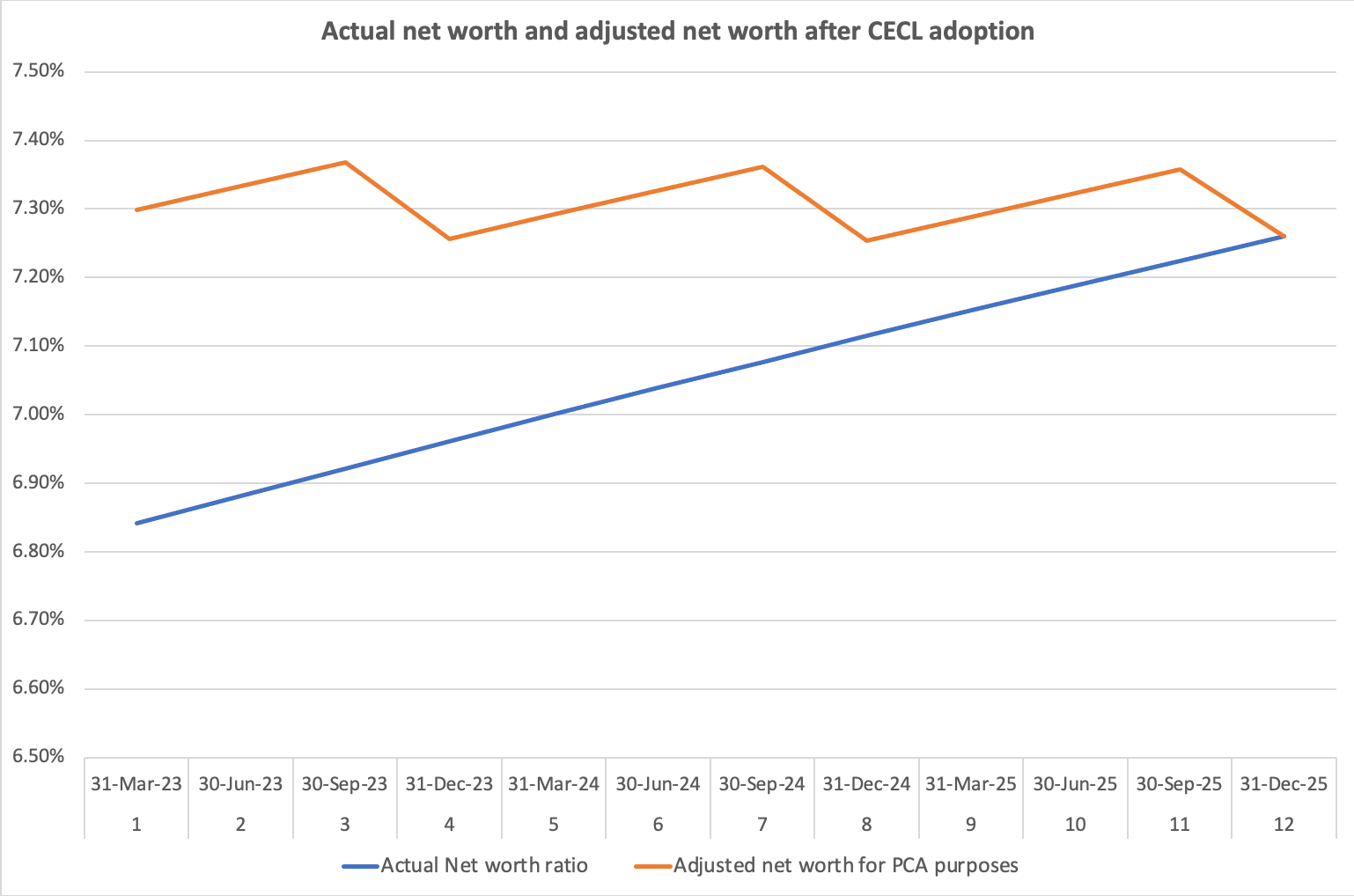

Here’s an example of a hypothetical credit union’s adjusted net worth for PCA compared to its actual net worth over the three year phase-in period.

As you can see, the actual net worth is lower than the net worth calculated for PCA. Had the NCUA not calculated this special net worth ratio for PCA purposes, the credit union would have found itself in PCA.

Exemption for credit unions under $10 million in assets

NCUA’s new rule also states that FICUs with less than $10 million in assets will not have to follow GAAP when determining their charges for loan losses. This essentially exempts these credit unions from adopting CECL. They can use any reasonable method to determine their appropriate reserve amounts, as long as the method adequately covers known and probable loan losses.

In effect, these credit unions can continue to use the incurred loss model they’ve used for years, as long as they consider other appropriate environmental and portfolio factors.

The sticky point for Utah’s credit unions is that it does not apply to Utah state-chartered credit unions, because NCUA doesn’t get to decide if state-chartered credit unions have to follow GAAP, or not. State law gets to decide. And, unfortunately, the Utah Credit Union Act requires all of Utah’s credit unions to follow GAAP.

This creates an unusual inequity among Utah’s credit unions under $10 million in assets: federally chartered credit unions don’t have to adopt CECL; state-chartered credit unions must adopt CECL.

Utah currently has 18 credit unions with less than $10 million in assets. Six of those credit unions are Federally chartered.

A few more notes about the phase-in

By the time the phase-in ends, as the chart above illustrates, the PCA net worth ratio should be identical to the reality of the books. This “adjusted PCA net worth ratio” will cease to be used. During this phase-in period, the net worth ratio will still be calculated as normal—it just won’t be used for PCA purposes. Examiners will still keep a close eye on it, and want to see it at a healthy level. As it relates to loan limits or other internal calculations, the usual ratio will still apply.

This phase-in will automatically be applied to credit unions that adopt CECL after December 15, 2022, and that experience a reduction in retained earnings due to the adoption of CECL. It’s possible that a credit union could adopt CECL and not experience any adverse effects. This is most likely for credit unions that have had a tendency to “over fund” their ALLLs—not that any credit unions would do that—or that were already using a methodology that calculated amounts close to CECL.

Note that this phase-in is not optional for credit unions adopting CECL after December 15, 2022. I’m not sure why you would not want the phase-in, but it’s not optional after that point. If your credit union doesn’t want the phase-in, you can adopt CECL prior to the deadline.

In addition, this phase-in only applies at the time of the adoption of CECL. A credit union that grows to more than $10 million in assets, which was not before subject to CECL, will not receive the phase-in when passing $10 million in assets. NCUA figures that “smaller FICUs will undertake the necessary analysis to determine the possible impact of coming into GAAP compliance in developing their business plans.” So, if your credit union will be passing $10 million within the next few years, it might be a good time to start planning for that one-time hit. Or just adopt CECL in the first quarter of 2023.

NCUA is still opposed to subjecting credit unions to CECL. The final rule says “The Board reiterates its belief that, given the unique characteristics of the credit union industry, the CECL accounting standards should not apply to FICUs. The Board will continue to work with FASB, the other banking agencies, and appropriate stakeholders to exempt FICU from these standards.”

So, there’s that. But don’t hold your breath that you won’t have to adopt CECL. It would likely require a statutory change.

In summary

The rule adopted by the NCUA board really benefits credit unions that have a net worth ratio close to 7%, and federally chartered credit unions with assets under $10 million that won’t grow past $10 million in the next few years.

To see how the phase-in will affect your PCA net worth calculation, use this spreadsheet.