Here are slides from the meeting, in pdf.

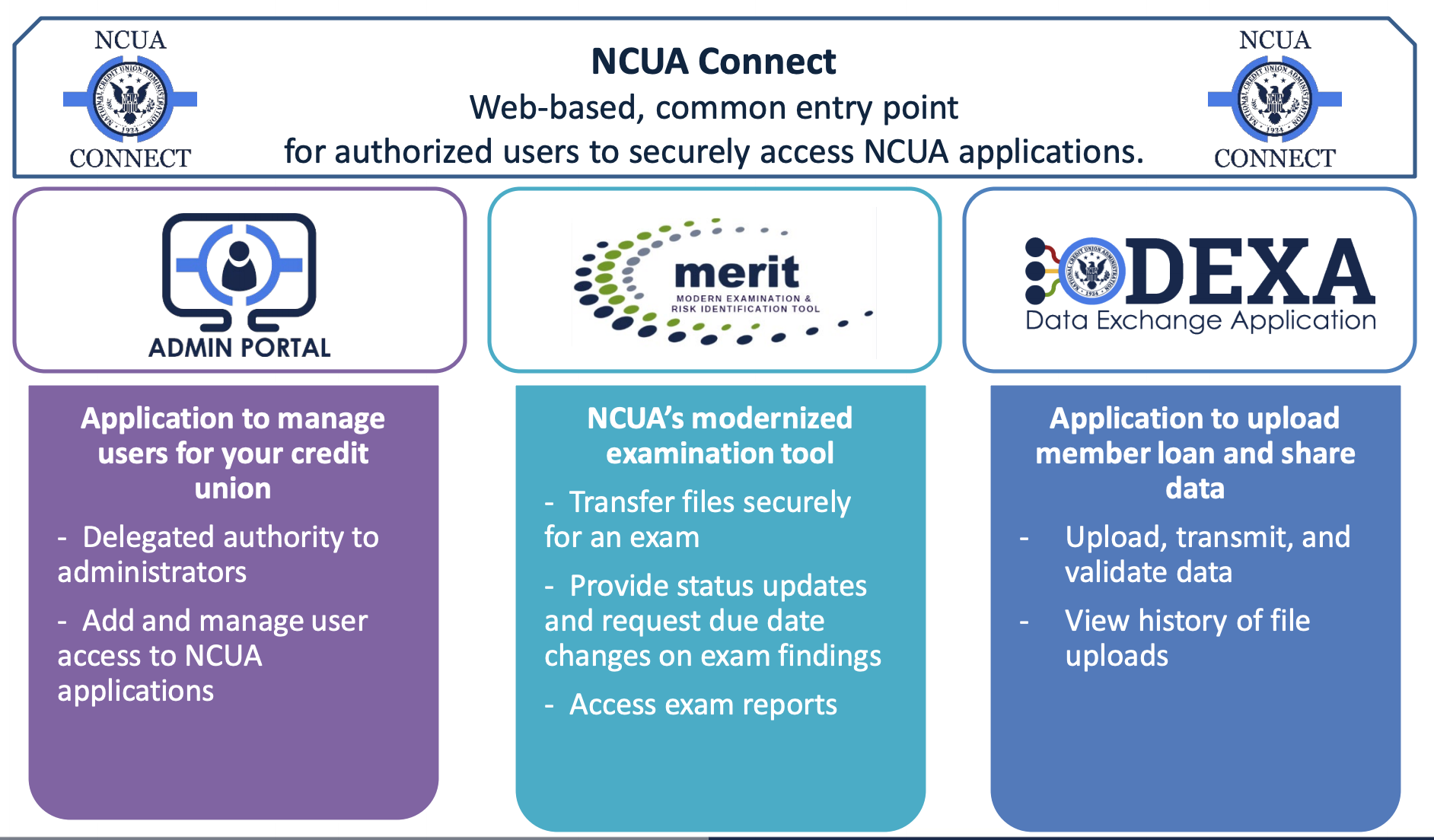

Turns out that the Modernized Examination and Risk Identification Tools (MERIT), are designed primarily to streamline the exam process by providing communication and project tracking tools.

There are actually several pieces to MERIT:

In the brief walk-through that NCUA gave in the webinar, the tool appears to be fairly intuitive once you nail down some of the terminology. Here’s what I see being the benefits:

It appears that the tool should make logistics of working with examiners easier, as all information is in one place. Even when the state is conducting an exam on a state-chartered credit union without the NCUA, the state and the credit union use the tool to move the exam along.

Notably, MERIT doesn’t affect how Call Reports are submitted, and using MERIT in your exam is not required. However, AIRES will be phased out later this year, meaning DEXA will be required. The DEXA files will also require an additional bit of information—mapping loan and share type codes to a standardize loan type similar to 5300 Call Report categories.

The screen shots that NCUA showed looked fine. The user interface looked functional and clean. The real proof will be when you start using the tool, and whether it functions as advertised. I’d be interested in hearing your feedback on it, once you have a chance to use it.