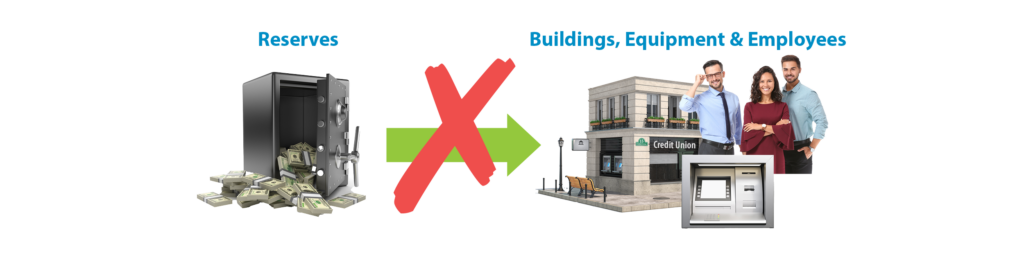

Credit union opponents claim that credit unions use their retained earnings to enrich their employees, or to build big fancy buildings. This makes it sound like credit unions spend their retained earnings on extravagances.

As usual, the truth is far more nuanced than banker exaggerations.

For a financial institution, retained earnings are first and foremost a requirement of the law. They act as a safety net for the deposits of the member or customer.

For a credit union, these required reserves can only be used to offset the charge-off (loss) of loans that are not repaid, or to absorb a net operational loss. If the reserves were not adequate to meet these losses, the savings of the depositors would be at risk.

Secondary to the safety factor, in a very practical manner, retained earnings in a credit union represent a pool of money that, until called upon for that unforeseen emergency, is not owned by any one member. Rather, the body of membership owns those earnings. As a result, the earnings from these monies can be used, in a general way, to increase the level of service given to the members.

In the case of the bank, retained earnings are used to calculate the value of the stock. Greater retained earnings increase the value of the stock, which in turn increase the profit made on the sale of that stock.

Such an option does not exist for a credit union member.

As already stated, retained earnings provide safety for the depositor and stability to the credit union. This is the obvious purpose of the retained earnings.

However, for both banks and credit unions, retained earnings represent funds that have no cost to the institution. That is, the bank or credit union does not have to pay anyone for these moneys, because they belong to the owners—the stockholders in the case of the bank, and the collective membership in the case of the credit union. This contrasts with deposits, which have a cost to the bank or credit union—the interest paid on the deposits.

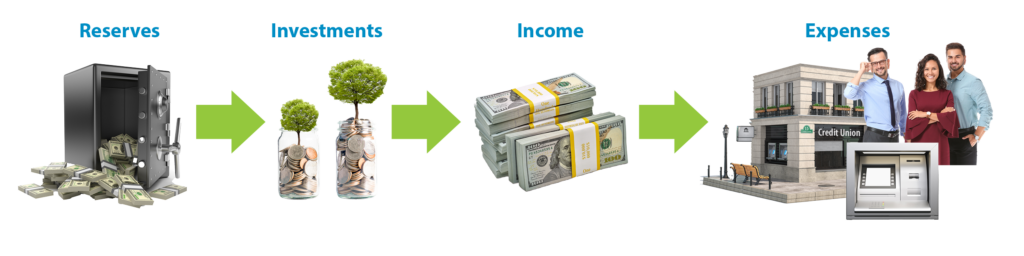

Just as with earnings from investing or lending member deposits, earnings from investing or lending reserves can be used to cover day-to-day expenses of the institution. That is, the institution uses those retained earnings to make loans or investments, and the income from those loans and investments are used to cover normal operating expenses.

Each institution has income and expenses. New buildings and most technology purchases are generally capitalized—which means they’re expensed (depreciated) over a period of years that closely represent the useful life of the item in question.

When members (credit unions) or customers (banks) deposit money into their savings accounts, the institution has cash. The cash is then used to (1) make loans, (2) invest in allowable investments, (3) provide cash for withdrawals, and (4) meet day-to-day expenses. Each of the above occur daily. Less often, cash is used to purchase new equipment or to build new branches.

Each month, the credit union prepares a statement of profit and loss, which lists the income from various sources, as well as the expenses. Three of those expense items would be—building expense, computer expense, and employee expense.

If an institution doesn’t have sufficient current income to meet these expenses, or to meet the expenses of a new building or new computer, the purchase is generally not made. Likewise with employee expenses—they depend upon current income and not upon monies that were retained in previous years. As stated earlier, retained earnings can only be accessed to offset losses from uncollectable loans or absorb net losses.

A credit union cannot use reserves to build buildings, buy computers, make payroll, etc. In accounting terms, retained earnings on the liability side of the balance sheet cannot be spent as cash on the income statement to buy real property or equipment asset account, or to pay the employee expenses line item. It just doesn’t work like that.

Those reserves can (and should) be invested, and the return on that investment can be used to fund buildings, buy computers, pay members higher dividends, etc.

This means that a credit union can’t simply spend reserves on a building, or equipment, or employees. Rather, it creates a business plan to serve members and earn income to cover expenses. If something goes wrong with the business plan and expenses aren’t covered, the loss comes out of the reserves.

If things go wrong with the business plan on a consistent basis, regulators will step in and act. It’s in the credit union’s best interests to always have a positive net income—just like with a bank.

So, no—credit union’s aren’t spending capital to build big fancy buildings or enrich employees. They use that capital to fund a legitimate business plan.