Who owns the equity of a bank or credit union? The answer to this question demonstrates just how different the cooperative credit union structure is from for-profit bank structure.

Laws require every bank[1] and credit union[2] to build and maintain equity. This is sometimes loosely referred to by different names: capital, reserves, or equity. Sound business practice and regulatory culture encourage more capital than is mandatory, so both banks and credit unions tend to build more capital than the law requires. [3] [4]

Who does this capital belong to? You may think, “Obviously, it belongs to the financial institution.” But the answer is more nuanced than that, especially if you ask the question a little differently: what people does that capital belong to?

This question is easily answered by considering what happens to the capital when the institution dissolves (ceases to do business). This simple chart illustrates the answers:

When it’s boiled down to the most basic facts, in both cases the owners get their share of capital. In the case of banks, owners are not necessarily customers. In the case of credit unions, owners absolutely are customers.

To a degree, the example is theoretical. Very few banks dissolve. If they do, it’s usually because they’ve run into trouble and their capital is gone or close to gone. But if one did dissolve, and still had capital, the capital would go to the stockholders—the owners. This is standard business practice.

The example is less theoretical for credit unions and their members.

In summer 2022, Employees First Credit Union in Logan Utah dissolved. It was a small credit union, with about 546 members and under $2 million in assets. For perspective, at the time, the average assets size of Utah’s credit unions was $824 million, and the average number of members was 62,000. So, this was a small credit union, but as far as its structure, Employees First’s was the same as every other credit union: cooperatively owned by members.

When Employees First dissolved, who took possession of those capital?

How can the capital go to both the owners and the customers? Because at a credit union the owners and the customers are the same people.

Members of Employees First Credit Union received their share of the capital based on two factors: their tenure as a member, and their account balances. Other credit unions have dissolved and used other criteria—how these funds are distributed is not mandated by any law, but certainly boards strive for fairness.

Based on those two criteria, customers (members) of Employees First received payouts ranging from $0.00 (no deposits and very short tenure) to $3,071 (large deposits and long tenure). Those figures are, of course, outliers. The average payout was $310.

This means that each member—the average, every-day person that used the credit union—received on average a payout of $310.

Earlier in 2022, Tri-County Credit Union, based in Panguitch, Utah and with $150,000 in assets, also liquidated and distributed all its capital back to all 61 members. At this credit union, members received, on average, $650.

These liquidations meaningfully demonstrate who, ultimately, the financial institution exists to benefit. And, by the way, the distribution of capital to the members did not escape taxation. The members were taxed on their share of the capital.

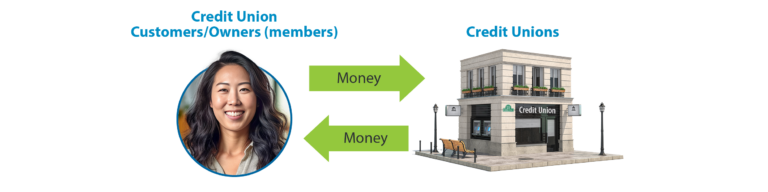

The members paid to use the credit union’s services. After covering its expenses, the credit union retained some of that money, as required by law. When done with the retained earnings, the credit union returned it to the owners—the customers—the members. Money flowed through the credit union back to the average customer.

At a bank, the customers pay money to use the bank services. The bank uses that money to cover expenses, then retains the rest in capital, as required by law. When the bank finishes with the capital, the money goes to the stockholders of the bank. Money flowed away from the customer, into the pockets of the bank owners.

This matters because many people consider their financial institution to be a detached third party which they have no interest in beyond using the products and services. It’s like Walmart or Comcast or some other large company that just provides a service.

But with the credit union that’s not really the case. When the credit union retains money, it’s holding it for the member while it provides services to that member. It returns funds to members as possible throughout each year, and ultimately at dissolution. No bank customer would ever get that kind of treatment because the bank exists not for the customer, but for the stockholder.

This is a prime example of how, at credit unions, the cooperative ownership structure makes all the difference.

[1] https://www.investopedia.com/terms/c/capitalrequirement.asp

[2] https://www.ncua.gov/files/publications/guides-manuals/chapter16.pdf

[3] Bank capital is complicated, but can generally be understood to be at 8%. Capital levels are generally at 10.12% as of June 30, 2021. For information about bank capital requirements, see the FDIC’s guidance: https://www.fdic.gov/regulations/safety/manual/section2-1.pdf. For information about bank capital levels, see the FDIC’s reports, found here: https://www.fdic.gov/analysis/quarterly-banking-profile/statistics-at-a-glance/

[4] Credit unions are generally required to have 7% capital. As of . For information about credit union capital requirements, see NCUA’s rules and regulations: https://www.ecfr.gov/current/title-12/chapter-VII/subchapter-A/part-702. On June 30, 2021, the credit union system’s capital level was 10.17%. See details here: https://www.ncua.gov/analysis/credit-union-corporate-call-report-data/quarterly-data-summary-reports.

[5] https://www.investopedia.com/terms/b/bank-capital.asp

[6] https://www.ecfr.gov/current/title-12/chapter-VII/subchapter-A/part-710