Utah’s credit unions continue their long-held habit of exceeding the nation’s credit unions on many key growth metrics, as shown in the Utah Credit Union Association’s analysis of quarterly Call Report data, which focuses on Utah’s credit unions.

The first page of the report shows that Utah credit unions have higher growth than the nation’s credit unions in loans, shares, capital, and assets. They also have a higher loans/shares ratio.

While the state’s net worth/assets ratio is about 75 basis points lower, it remains well over the statutory definition of “well capitalized”: 7%. In addition, the capital/assets ratio, which includes reserves for losses, closes that gap by nearly 25 basis points, demonstrating that Utah credit unions have healthy reserves for losses.

As recent quarterly reports show, the economy is not cooking along at the same pace it was two years ago. Return on assets has decreased across the board, loans are growing more slowly than in 2022-2023, delinquencies have returned to pre-pandemic norms, and charge-offs have risen slightly over pre-pandemic levels.

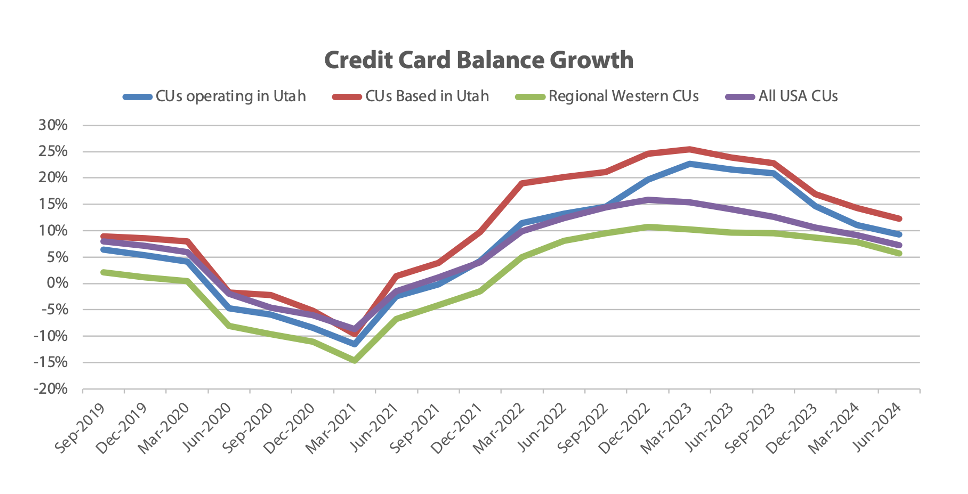

Credit cards tell an interesting story: balances grew in 2022 and 2023, and subsequently delinquency has increased. The commonly held belief is that consumers used credit cards to cope with high inflation, rather than implementing personal or familial austerity measures.

The report includes charts and graphs showing trends in lending, product penetration, shares, asset quality, income, and more. It also breaks some data down by asset size.